Hello!

Thanks much for all your answers and suggestions. It has been taking me awhile to digest and work on your recomendations. I really appreciatte all the info and time.

Regarding my income and low expenses, I will explain that. I live with my fiance in his house. He covers all the expenses of the house. The last few years, I have cut a lot of my personal expenses because of the fund of my retirement account. So currently my expenses are around $500 to $1000 per month (helping financially my parents, who live in Peru). My fiance owns rental properties and I work for him as a property manager.

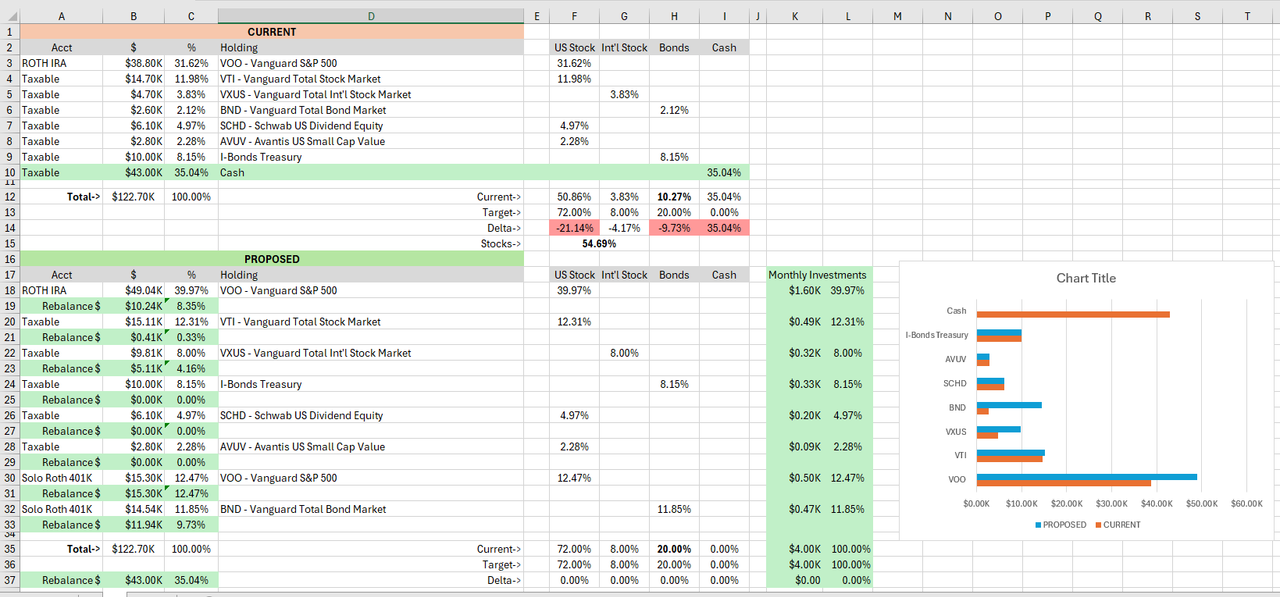

Per the information provided by you and my research I was able to modified the proposed portafolio (thanks much for the link):

Image may be NSFW.

Clik here to view.

I have sold my VTTHX Varguard target fund 2035 and bought VOO for $38.8K. I also decided that I am not "yet" ready to let go AVUV and SCHD. I supossed that with the time I will convert them to VTI.

The opening of my Roth Solo 401k is taking some time because I notice that Vanguard (where I have my BND) thats no offer ETF's in their solo 401k and Ascensus is runing it and they also charge extra fees for that account. Well that was a bummer for me, so I was reading/searching about Schwab and E-Trade. Both of them hold ETF's in their solo Roth 401K, however, Schwab do not have an online transfer for that plan yet, but E-Trade does has it. So probably, I will go with E-trade, but I need to find out if I can transfer my BND from Vanguard to E-trade?. How/Where do you guys handle their 401k ?

My next step will be research about the Monte Carlo system. I would like to add that worksheet to trace my progress.

Per your suggestions as well, I notice that I am holding too much cash on my Capital 1 savings account, so I will reduce that amount to probably $5k instead of $10k, just as a piece of mind for me.

Any more suggestions, recomendations are really very appreciated.

Thank you!

Pam.

Thanks much for all your answers and suggestions. It has been taking me awhile to digest and work on your recomendations. I really appreciatte all the info and time.

Regarding my income and low expenses, I will explain that. I live with my fiance in his house. He covers all the expenses of the house. The last few years, I have cut a lot of my personal expenses because of the fund of my retirement account. So currently my expenses are around $500 to $1000 per month (helping financially my parents, who live in Peru). My fiance owns rental properties and I work for him as a property manager.

Per the information provided by you and my research I was able to modified the proposed portafolio (thanks much for the link):

Image may be NSFW.

Clik here to view.

I have sold my VTTHX Varguard target fund 2035 and bought VOO for $38.8K. I also decided that I am not "yet" ready to let go AVUV and SCHD. I supossed that with the time I will convert them to VTI.

The opening of my Roth Solo 401k is taking some time because I notice that Vanguard (where I have my BND) thats no offer ETF's in their solo 401k and Ascensus is runing it and they also charge extra fees for that account. Well that was a bummer for me, so I was reading/searching about Schwab and E-Trade. Both of them hold ETF's in their solo Roth 401K, however, Schwab do not have an online transfer for that plan yet, but E-Trade does has it. So probably, I will go with E-trade, but I need to find out if I can transfer my BND from Vanguard to E-trade?. How/Where do you guys handle their 401k ?

My next step will be research about the Monte Carlo system. I would like to add that worksheet to trace my progress.

Per your suggestions as well, I notice that I am holding too much cash on my Capital 1 savings account, so I will reduce that amount to probably $5k instead of $10k, just as a piece of mind for me.

Any more suggestions, recomendations are really very appreciated.

Thank you!

Pam.

Statistics: Posted by PamPeru — Sat Jun 29, 2024 12:41 am — Replies 18 — Views 3703