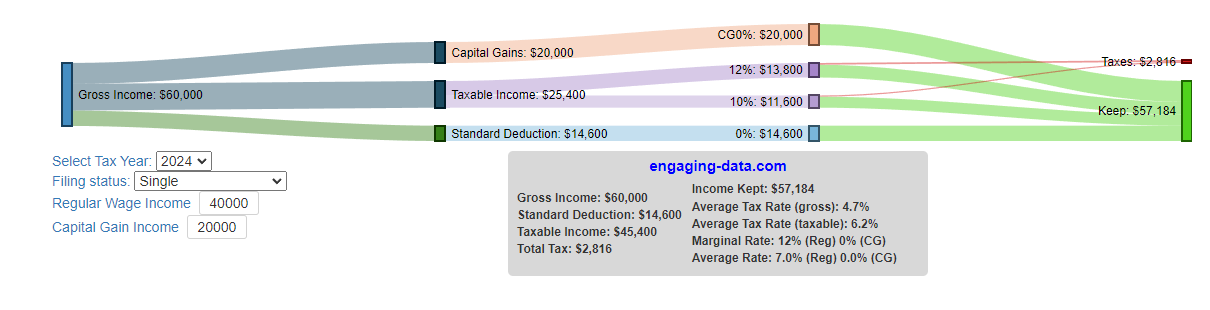

Yeah something still doesn't make sense to me, playing with a different set of numbers:

LTCG: $20K

Ordinary income: $40K (below $47,025)

![Image]()

LTCG are in the 0% tax bracket

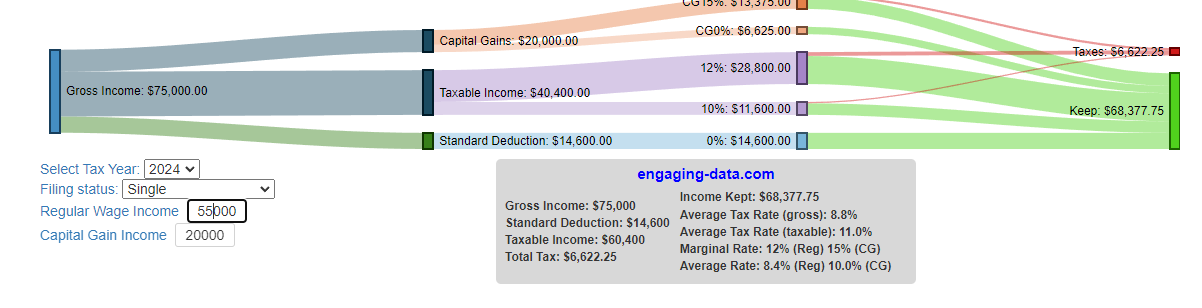

LTCG: $20K

Ordinary income: $55K (above $47,025)

![Image]()

LTCG are split between 0% and 15%

How is the portion taxed at 0% determined?

then

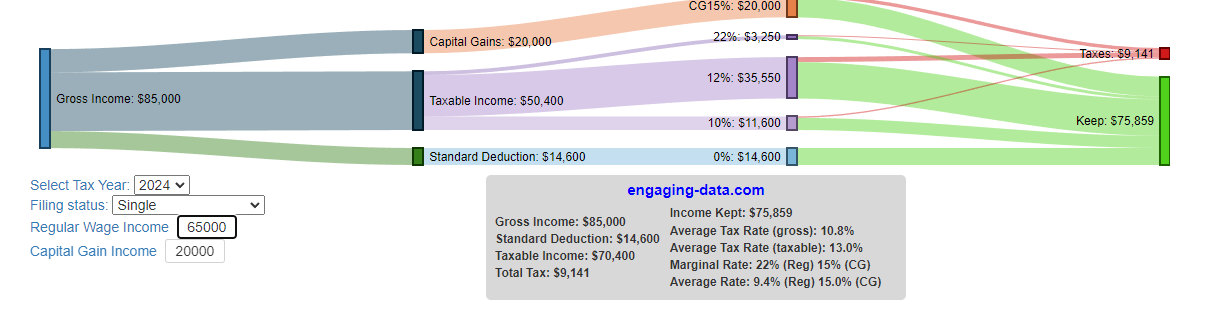

LTCG: $20K

Ordinary income: $65K (above $47,025)

![Image]()

Now all LTCG is taxed at 15%? it's not a progressive system?

I am obviously missing something.

LTCG: $20K

Ordinary income: $40K (below $47,025)

LTCG are in the 0% tax bracket

LTCG: $20K

Ordinary income: $55K (above $47,025)

LTCG are split between 0% and 15%

How is the portion taxed at 0% determined?

then

LTCG: $20K

Ordinary income: $65K (above $47,025)

Now all LTCG is taxed at 15%? it's not a progressive system?

I am obviously missing something.

Statistics: Posted by Raspberry-503 — Mon Apr 01, 2024 12:56 pm — Replies 11 — Views 263