There are two other ongoing threads on the DIA, by StillGoing (viewtopic.php?t=433101) and GoWithTheCashFlow (viewtopic.php?t=433584). The approach I’ll be taking here seemed sufficiently distinct to start a third thread, but whether it gets folded in to one of the others is up to moderators.

The argument for the Deferred Income Annuity (DIA)

As I understand it, the argument in favor of a deferred income annuity over a single premium immediate annuity (SPIA) has two parts.

1.The ordinary investor cannot equal the return guaranteed by the insurance company, with its greater investing acumen and its enormous resources over which risk can be spread.

2.Deferred income payouts can be higher still, because of mortality debits (aka, some people die young). If 2% of the pool dies off during the deferral period, then ceteris paribus, deferred payouts can be 100/98ths as large as pure investment performance could support. If 5% die off, 100/95ths; if 15%, then 100/85ths. That really starts to add up.

In short:

-insurer superior investment return + mortality debits

>>> (“must be greater than”)

-ordinary investor returns with no mortality adjustments

There is a 3rd, more intangible argument resting on a halo effect. Many of us on the forum, myself included, argue for deferring social security until age 70, to get more of the world’s best inflation-adjusted life annuity.

Likewise, government workers with a traditional pension will be familiar with the idea that the longer they work and the older they are at retirement, the greater the pension payout.

That’s two counts in favor of the principle of deferral; maybe the DIA makes it three?

Evaluation

Money illusion infects casual comparisons of the SPIA and DIA. I mean to control for it, and harness it for my riposte. So my hypothetical couple has $1,000,000 available to potentially annuitize. Not at all unrealistic here on the forum, where total assets may run to 2, 3, 4 or more millions. Thus, annuitizing one million dollars remains consistent with the standard advice: “nobody recommends annuitizing everything”.

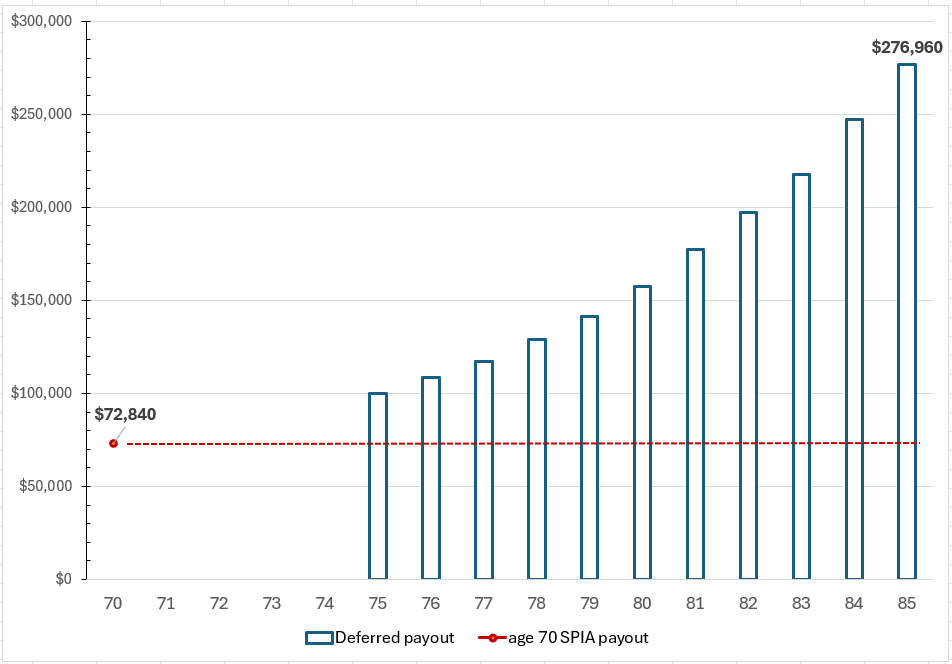

To get payout amounts, I went to immediateannuities.com at about 4pm Pacific on June 14th. I pulled SPIA quotes for a couple age 70 in California, and then deferred income annuity quotes for the same couple if they deferred payments to age 75, 76 … 84, 85. Then I went back and pulled quotes for what an SPIA would pay, at today’s rates, for a couple age 75, 80, 85.

No refunds, no guarantee, just bare naked annuities in both cases.

Here is how it looks graphically.

![Image]()

Wow! A piddling $73,000 per year if they annuitize immediately, or $277,000 if they defer the full fifteen years. That latter amount should be enough to keep you out of the Medicaid facility! And later, fund a nice 105th birthday party for whichever of you lives that long.

Hmmm. Taken at face value, looks like a slam dunk in favor of deferral.

Challenge #1: About those mortality debits

Please take this short quiz:

1.The probability that a couple age 70 will still have at least one member alive in five years is about:

A.99.25%

B.98.7354%

C.98%

D.97.6283%

E.Less than 97.5%.

*IRS mortality tables, assumes annuitant mortality.

Actually, it is 99.624%.

That’s not going to give much of a boost to the five-year DIA—100/.996 larger a payment from harvesting mortality debits contributed by the, ah, losers.

BTW, it’s 97.549% after 10 years, and 90.142% after fifteen years. So, at fifteen years, maybe 100/.901 as large a payout for that longer deferral. That’s … something.

Conclusion: it takes longer than ten years, well into the 80s, before mortality debits really begin to boost the deferred annuity payouts. A stronger investment return—like the difference between the yield on a long bond versus a short bond—could easily overcome the small mortality debits characteristic of annuitants in their 70s.

Challenge #2: investment returns

Tom Bogle, diligent as always, sits down with an insurance salesman to probe the question of why deferred annuities pay out so much more:

“I’m thinking I could duplicate the payout if I invest the money myself in the interim and then put it into an ordinary SPIA later.”

Salesman, shaking his head, chuckling genially: “No, no, no. We hire the best and the brightest and set them loose on the vast array of sophisticated investments available to a megacorporation like XYZ Insurance. We can tolerate BB and B bonds that your investment-grade bond fund can’t touch because we can spread out the risk. We’ve also got private credit, structured mortgage products, private placements, CLOs, real estate, oh my, just a load of stuff that you can’t buy in a mutual fund or ETF.”

Tom Bogle nods, thinks for a moment. “What’s your expense ratio? Those rocket scientists can’t come cheap.”

Salesman, shuffling papers. “We’re not regulated under the Investment Company Act of 1940, so the term expense ratio doesn’t apply here.”

Tom Bogle: “But you do have expenses right? And are you a non-profit?”

Salesman, bristling: “We are profitable! We're among the leaders in the industry in our return on capital. You might even consider a side investment in our stock, it has beat the S&P Financial ETF over the past 5-, 10- and 15-year periods.”

Tom Bogle, extending arms palm out and lowering them, speaking in a contrite tone: “Of course, of course, I too am a believer in entrepreneurial capitalism, I expect an S&P index member like yourself to cover all costs and earn a favorable return on capital.”

“I’m just saying that the only source of cost coverage and profit that I can see is those high investment returns. You gotta be taking at least 50, 70 basis points off the top, right?”

Salesman, standing and walking over to the door: “I’m really sorry to cut this short but I’ve got a meeting where I dare not be late, let’s talk again soon.”

Tom Bogle smiles broadly. “Of course.” He walks out, remembering that tale of two guys being chased by a bear.

My point: the ordinary investor doesn’t have to beat the return on those structured doohickeys and private thingamajigs that only insurance companies can buy; they just have to be able to match what’s left after the insurance company, competing with other S&P firms for capital, subtracts costs and its profit target.

As a case in point, the SPIA quote in the chart corresponds to a crediting rate of about 4.9%. Today, at Vanguard, you could assemble a duration-matched mix of the VCSH, VCIT, and VCLT ETFs with SEC yields of 5.31%, 5.42%, and 5.68%, respectively.

Or you could buy TIPS with a yield of 2.10%, which on top of trailing inflation of 3.3%, would also give you an expected nominal yield of 5.4% (you knew that was coming here in a thread by McQ, eh?).

BTW, I don’t mean to knock the valuable service performed by the financial intermediary known as an insurance company. If you trust the guarantee, that 4.9% crediting rate on today’s SPIA is well above what you could earn on a portfolio of long Treasuries, maybe 4.4% as of June 14th, laddered to your life expectancy. But it is not as great as you could earn from an investment grade bond fund. And after all, the insurance company is itself an investment grade corporation; so how is its “guarantee” any more guaranteed than the promise to pay interest and principal made by some other investment grade corporation on its bonds?

The only true guarantee comes from Treasuries—and you’ve got to forfeit income as the price of that ultimate in guarantees. Life annuities are a good business, making a firm worthy of being included in the S&P Index, because for many investors, the insurance company’s pseudo-guarantee, combined with several dozen basis points of excess return over Treasuries, sounds like, and is, a good deal.

Especially given the uncertainty of life spans, the ensemble is attractive.

But the preceding paragraphs pertain to SPIAs—not DIAs.

Can the ordinary investor simulate a deferred income annuity on their own?

Let’s be clear: an ordinary investor CANNOT simulate a pure life annuity on their own because they do not know how long they shall live.

But a deferred annuity is deferred for a specific number of years. Completely different.

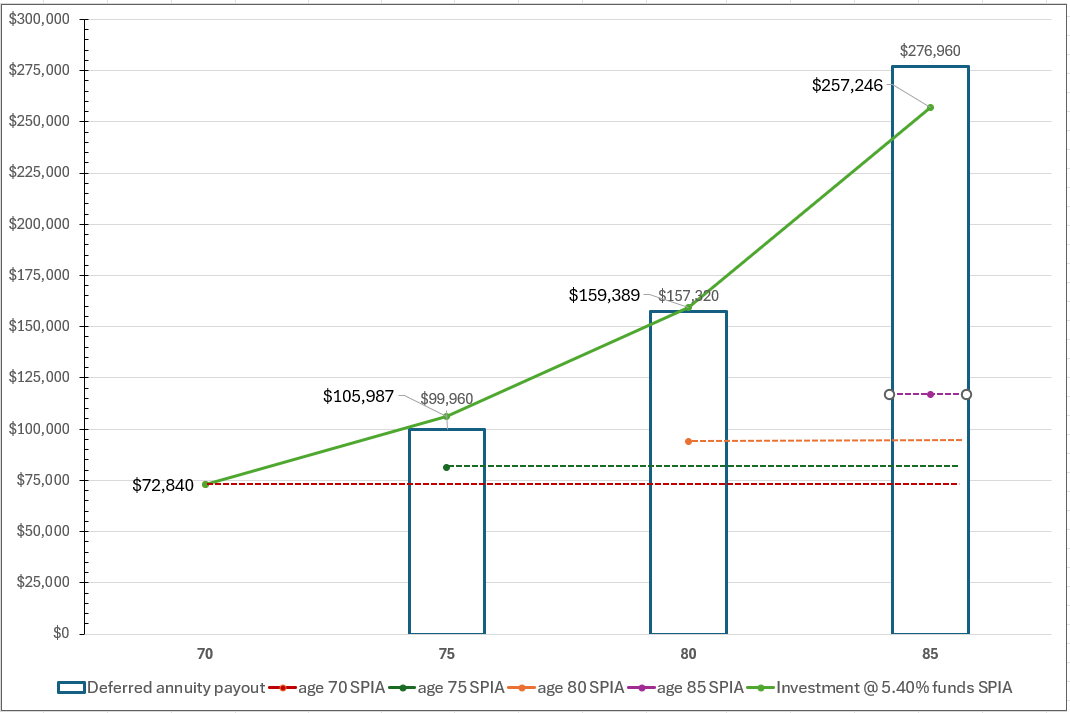

In this next chart I show the SPIA amounts at later ages (if current rates hold) against the deferred payouts (dashed lines versus the hollow bars). I then show the total payout if the amount available to invest in that later SPIA is $1,000,000 incremented by 1.054 per year.

![Image]()

So in this analysis Tom Bogle defers buying an SPIA until later. He takes the funds that he could have annuitized immediately, SPIA or DIA, and “self insures” by investing them somewhere with an expected investment return of 5.4%. His self-insured payout at age 75, 80, 85 is the expanded investment (1.054 to the 5th, 10th, or 15th power) multiplied by the SPIA rate at age 75, 80, 85. (Solid green line)

Tom wins with a 5 year deferral.

Tom wins with a 10 year deferral.

But the insurance company wins with a 15 year deferral, $277,000 versus $257,000.

Because only with a delay that long do mortality debits begin to become consequential;* and Tom Bogle cannot harvest mortality debits on his own, that requires a pool.

*The crossover point is about age 82, twelve years out.

I should point out that if the TIPS bonds with real yield of 2.10% should see inflation over the fifteen years of 3.85%, not 3.3%, then Tom Bogle would nose out a win at the fifteen-year mark as well.

Take a good look at the insurance company’s margin of victory fifteen years out. In real terms, with inflation compounding at 3.3% for the fifteen years, it equals about $12,000 in 2024 dollars. Nominally, It's about 5% greater than the invest-yourself-and-SPIA-later payout amount.

To harvest that margin, would you hand over $1,000,000, and wait fifteen years, as opposed to retaining the funds for investment, and later taking out an SPIA—or not—at some future point of your choosing?

I would not.

The argument for the Deferred Income Annuity (DIA)

As I understand it, the argument in favor of a deferred income annuity over a single premium immediate annuity (SPIA) has two parts.

1.The ordinary investor cannot equal the return guaranteed by the insurance company, with its greater investing acumen and its enormous resources over which risk can be spread.

2.Deferred income payouts can be higher still, because of mortality debits (aka, some people die young). If 2% of the pool dies off during the deferral period, then ceteris paribus, deferred payouts can be 100/98ths as large as pure investment performance could support. If 5% die off, 100/95ths; if 15%, then 100/85ths. That really starts to add up.

In short:

-insurer superior investment return + mortality debits

>>> (“must be greater than”)

-ordinary investor returns with no mortality adjustments

There is a 3rd, more intangible argument resting on a halo effect. Many of us on the forum, myself included, argue for deferring social security until age 70, to get more of the world’s best inflation-adjusted life annuity.

Likewise, government workers with a traditional pension will be familiar with the idea that the longer they work and the older they are at retirement, the greater the pension payout.

That’s two counts in favor of the principle of deferral; maybe the DIA makes it three?

Evaluation

Money illusion infects casual comparisons of the SPIA and DIA. I mean to control for it, and harness it for my riposte. So my hypothetical couple has $1,000,000 available to potentially annuitize. Not at all unrealistic here on the forum, where total assets may run to 2, 3, 4 or more millions. Thus, annuitizing one million dollars remains consistent with the standard advice: “nobody recommends annuitizing everything”.

To get payout amounts, I went to immediateannuities.com at about 4pm Pacific on June 14th. I pulled SPIA quotes for a couple age 70 in California, and then deferred income annuity quotes for the same couple if they deferred payments to age 75, 76 … 84, 85. Then I went back and pulled quotes for what an SPIA would pay, at today’s rates, for a couple age 75, 80, 85.

No refunds, no guarantee, just bare naked annuities in both cases.

Here is how it looks graphically.

Wow! A piddling $73,000 per year if they annuitize immediately, or $277,000 if they defer the full fifteen years. That latter amount should be enough to keep you out of the Medicaid facility! And later, fund a nice 105th birthday party for whichever of you lives that long.

Hmmm. Taken at face value, looks like a slam dunk in favor of deferral.

Challenge #1: About those mortality debits

Please take this short quiz:

1.The probability that a couple age 70 will still have at least one member alive in five years is about:

A.99.25%

B.98.7354%

C.98%

D.97.6283%

E.Less than 97.5%.

*IRS mortality tables, assumes annuitant mortality.

Actually, it is 99.624%.

That’s not going to give much of a boost to the five-year DIA—100/.996 larger a payment from harvesting mortality debits contributed by the, ah, losers.

BTW, it’s 97.549% after 10 years, and 90.142% after fifteen years. So, at fifteen years, maybe 100/.901 as large a payout for that longer deferral. That’s … something.

Conclusion: it takes longer than ten years, well into the 80s, before mortality debits really begin to boost the deferred annuity payouts. A stronger investment return—like the difference between the yield on a long bond versus a short bond—could easily overcome the small mortality debits characteristic of annuitants in their 70s.

Challenge #2: investment returns

Tom Bogle, diligent as always, sits down with an insurance salesman to probe the question of why deferred annuities pay out so much more:

“I’m thinking I could duplicate the payout if I invest the money myself in the interim and then put it into an ordinary SPIA later.”

Salesman, shaking his head, chuckling genially: “No, no, no. We hire the best and the brightest and set them loose on the vast array of sophisticated investments available to a megacorporation like XYZ Insurance. We can tolerate BB and B bonds that your investment-grade bond fund can’t touch because we can spread out the risk. We’ve also got private credit, structured mortgage products, private placements, CLOs, real estate, oh my, just a load of stuff that you can’t buy in a mutual fund or ETF.”

Tom Bogle nods, thinks for a moment. “What’s your expense ratio? Those rocket scientists can’t come cheap.”

Salesman, shuffling papers. “We’re not regulated under the Investment Company Act of 1940, so the term expense ratio doesn’t apply here.”

Tom Bogle: “But you do have expenses right? And are you a non-profit?”

Salesman, bristling: “We are profitable! We're among the leaders in the industry in our return on capital. You might even consider a side investment in our stock, it has beat the S&P Financial ETF over the past 5-, 10- and 15-year periods.”

Tom Bogle, extending arms palm out and lowering them, speaking in a contrite tone: “Of course, of course, I too am a believer in entrepreneurial capitalism, I expect an S&P index member like yourself to cover all costs and earn a favorable return on capital.”

“I’m just saying that the only source of cost coverage and profit that I can see is those high investment returns. You gotta be taking at least 50, 70 basis points off the top, right?”

Salesman, standing and walking over to the door: “I’m really sorry to cut this short but I’ve got a meeting where I dare not be late, let’s talk again soon.”

Tom Bogle smiles broadly. “Of course.” He walks out, remembering that tale of two guys being chased by a bear.

My point: the ordinary investor doesn’t have to beat the return on those structured doohickeys and private thingamajigs that only insurance companies can buy; they just have to be able to match what’s left after the insurance company, competing with other S&P firms for capital, subtracts costs and its profit target.

As a case in point, the SPIA quote in the chart corresponds to a crediting rate of about 4.9%. Today, at Vanguard, you could assemble a duration-matched mix of the VCSH, VCIT, and VCLT ETFs with SEC yields of 5.31%, 5.42%, and 5.68%, respectively.

Or you could buy TIPS with a yield of 2.10%, which on top of trailing inflation of 3.3%, would also give you an expected nominal yield of 5.4% (you knew that was coming here in a thread by McQ, eh?).

BTW, I don’t mean to knock the valuable service performed by the financial intermediary known as an insurance company. If you trust the guarantee, that 4.9% crediting rate on today’s SPIA is well above what you could earn on a portfolio of long Treasuries, maybe 4.4% as of June 14th, laddered to your life expectancy. But it is not as great as you could earn from an investment grade bond fund. And after all, the insurance company is itself an investment grade corporation; so how is its “guarantee” any more guaranteed than the promise to pay interest and principal made by some other investment grade corporation on its bonds?

The only true guarantee comes from Treasuries—and you’ve got to forfeit income as the price of that ultimate in guarantees. Life annuities are a good business, making a firm worthy of being included in the S&P Index, because for many investors, the insurance company’s pseudo-guarantee, combined with several dozen basis points of excess return over Treasuries, sounds like, and is, a good deal.

Especially given the uncertainty of life spans, the ensemble is attractive.

But the preceding paragraphs pertain to SPIAs—not DIAs.

Can the ordinary investor simulate a deferred income annuity on their own?

Let’s be clear: an ordinary investor CANNOT simulate a pure life annuity on their own because they do not know how long they shall live.

But a deferred annuity is deferred for a specific number of years. Completely different.

In this next chart I show the SPIA amounts at later ages (if current rates hold) against the deferred payouts (dashed lines versus the hollow bars). I then show the total payout if the amount available to invest in that later SPIA is $1,000,000 incremented by 1.054 per year.

So in this analysis Tom Bogle defers buying an SPIA until later. He takes the funds that he could have annuitized immediately, SPIA or DIA, and “self insures” by investing them somewhere with an expected investment return of 5.4%. His self-insured payout at age 75, 80, 85 is the expanded investment (1.054 to the 5th, 10th, or 15th power) multiplied by the SPIA rate at age 75, 80, 85. (Solid green line)

Tom wins with a 5 year deferral.

Tom wins with a 10 year deferral.

But the insurance company wins with a 15 year deferral, $277,000 versus $257,000.

Because only with a delay that long do mortality debits begin to become consequential;* and Tom Bogle cannot harvest mortality debits on his own, that requires a pool.

*The crossover point is about age 82, twelve years out.

I should point out that if the TIPS bonds with real yield of 2.10% should see inflation over the fifteen years of 3.85%, not 3.3%, then Tom Bogle would nose out a win at the fifteen-year mark as well.

Take a good look at the insurance company’s margin of victory fifteen years out. In real terms, with inflation compounding at 3.3% for the fifteen years, it equals about $12,000 in 2024 dollars. Nominally, It's about 5% greater than the invest-yourself-and-SPIA-later payout amount.

To harvest that margin, would you hand over $1,000,000, and wait fifteen years, as opposed to retaining the funds for investment, and later taking out an SPIA—or not—at some future point of your choosing?

I would not.

Statistics: Posted by McQ — Sun Jun 16, 2024 10:00 pm — Replies 0 — Views 80